NetSuite’s Cloud ERP system goes above and beyond the essentials of running an e-commerce store, tracking inventory, and generating reports. It’s got you covered with a crucial feature that most businesses need: NetSuite credit card processing.

NetSuite offers various convenient ways to accept credit card payments. Businesses can effortlessly manage their back-end and sales operations through point-of-sale, online transactions, or mobile sales through its all-in-one system. This helps save costs and reduce time spent.

There’s so much more to discover about Credit Card Processing in NetSuite! Let’s dive into it together through this blog.

The Importance of NetSuite Credit Card Processing

Smooth operations require smooth money movement, and that’s where NetSuite comes in. Its credit card payment processing capabilities are pure magic.

Here’s why it’s a game-changer:

Smooth Sailing Operations

NetSuite handles all the tedious tasks, such as creating invoices and organizing payments. With the hassle of paperwork out of the way, they can focus on strategic financial planning, analyzing data to spot growth opportunities, and building stronger client relationships.

Cash Flow Boost

With NetSuite, payments hit your account faster, allowing businesses to maintain a steady cash flow. This is a significant advantage as it enables you to clearly understand your financial situation, empowering you to make informed and strategic decisions when it comes to managing your money.

Happy Customers

NetSuite gives your customers choices. They can pay with credit cards, bank transfers, or use fancy electronic methods. It’s all about making their lives easier and keeping them smiling. Happy customers mean a happy business. With NetSuite, payments become effortless, cash flow, and customers are left with big smiles.

NetSuite Credit Card Processing Terms

- Gateway: Think of the gateway as the secure online bridge between your business and the payment system. It helps your online store communicate payment details safely, like a virtual cash register for Internet transactions.

- Processor: The processor acts as a middleman. It’s like the liaison between your business, the customer’s card, and the banks. It ensures that transactions are approved and the money smoothly moves from the customer to your business.

- Acquirer: The acquirer is the financial institution (bank) that manages your business account. The bank handles and settles the transactions made with credit or debit cards in your store, ensuring the money ends up in your business account.

Customer Credit Card Processing

NetSuite’s integrated credit card processing is a handy tool that helps efficiently handle credit card payments for your sales orders and website purchases. It simplifies the process, from authorizing cards to managing potential fraud and capturing funds for transactions where the card is not physically present.

Here are the key advantages of using NetSuite credit card processing integration:

Secure Transactions: Your customers’ card numbers are encrypted to ensure full compliance with PCI standards, and their data is stored securely.

Smooth Integration: The system seamlessly integrates with your sales orders, whether from mail or telephone orders (MOTO) or online purchases. This integration streamlines the approval and fund capture process.

Optimized Processing: For cost savings, the system supports payer authentication and level II and level III purchase card processing. This helps optimize the processing costs associated with different types of transactions.

Order Review: You can place holds on payments to review orders for validity before proceeding. This helps in preventing potentially problematic transactions.

Fraud Management: Leveraging CyberSource’s Decision Manager, the system provides tools for effective fraud management, adding an extra layer of security to your transactions.

Enhanced Reporting: By mapping sales order data to CyberSource reporting fields, you gain more insightful and detailed reports, helping you make informed decisions.

Statement Clarity: Soft descriptors are available, making it easy for your customers to identify and understand the transactions on their credit card statements.

Additionally, if you work with CyberSource or MerchantE, you can establish rules to ensure that only valid and credit-worthy orders are approved. Orders that don’t meet your approval criteria can be flagged for review, allowing you to assess them individually or in bulk. CyberSource’s Decision Manager offers extra verification tests and services to enhance your fraud management efforts further.

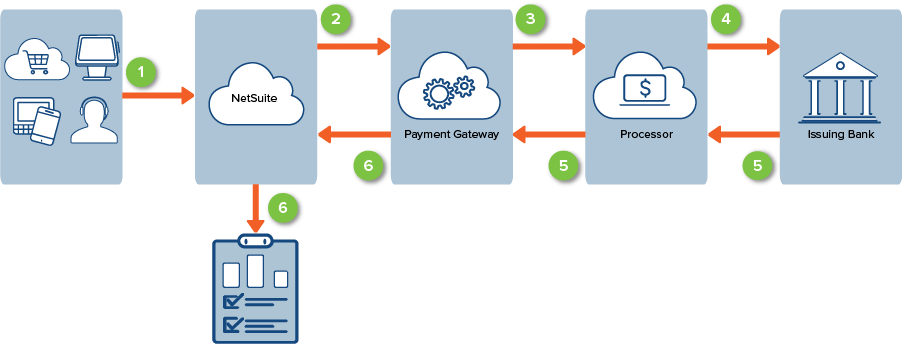

NetSuite Credit Card Processing Flow

This diagram showcases the credit card authorization process and how NetSuite communicates with the payment gateway.

Customer Orders: Someone buys something.

NetSuite Sends Request: Where they bought it sends details securely to a payment gateway.

Payment Gateway Talks to Bank: The payment gateway communicates with the bank as a middleman.

Bank Checks Funds: The bank checks for the purchase if there’s enough money.

Bank Approves or Denies: The Bank decides whether to approve (yes) or decline (no).

Result Goes Back to NetSuite: The payment gateway informs NetSuite of the bank’s decision.

NetSuite Updates Order: If approved, NetSuite updates the order status for further processing.

Transferring Credit Card Funds

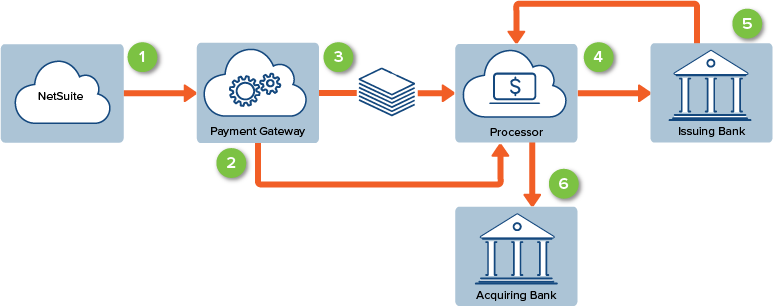

The following diagram illustrates the funds settlement (capture) process:

- Sales orders billed in NetSuite trigger capture requests to the payment gateway.

- Payment gateway checks and reauthorizes funds with the issuing bank if needed.

- Approved funds are added to the daily batch sent to the issuing bank.

- The issuing bank verifies and transfers funds to the acquiring bank.

- Acquiring bank credits to the merchant’s account.

How Do I Choose a NetSuite Payment Processor?

Selecting the right payment processor for your NetSuite environment is a critical decision that can impact your financial operations and customer experience. It is essential to consider several factors when choosing a NetSuite payment processor.

First and foremost, focus on integration—ensure that the payment processor seamlessly integrates with NetSuite, allowing for automatic synchronization of payment data and real-time updates.

Another crucial aspect is security—payment processing involves sensitive customer data, so it’s imperative to choose a processor that adheres to the highest security standards, such as PCI-DSS compliance.

Additionally, consider the available payment options provided by the processor and ensure they align with your customer’s preferences. Look for flexibility in accepting credit cards, bank transfers, and other electronic payment methods to enhance customer convenience.

Lastly, evaluate the fees associated with the payment processor, including transaction fees, monthly fees, and any additional charges. It’s essential to compare the fees of different processors to ensure you are getting the best value for your money.

If you need further information, feel free to contact us. The Folio3 NetSuite team is here to assist you with any NetSuite-related inquiries.

Final Thoughts

NetSuite credit card processing is a fantastic way to streamline all your business processes into one system. Why go through the hassle of dealing with multiple systems, risking errors, and potentially losing customers when you can have everything in one place?

When you partner with a credit card processor like Host Merchant Services, which is already well-versed in NetSuite-integrated payments, you significantly increase your chances of a seamless process while boosting customer retention.

With SuitePayments, you can enjoy faster payments, minimize the risk of fraud, have a convenient point-of-sale option, and securely store your customers’ card information for easy subscription charges and recurring payments. It’s all about making your life easier and your business more successful!