Fixed asset management is critical for businesses as it allows them to track and manage their long-term assets, which are often significant investments. By keeping accurate records of their fixed assets, companies can make informed decisions about purchasing, replacing, and disposing of assets and ensure compliance with accounting and tax regulations. Effective fixed asset management also helps businesses optimize their use of resources and improve their financial performance.

Although fixed assets are a crucial component of any business, not every system enables you to manage their depreciation and life cycle precisely. In reality, many businesses still use spreadsheets to keep track of their assets. By leveraging software solutions like NetSuite Fixed Asset Management, businesses can streamline their fixed asset management processes, reduce errors, and increase efficiency, ultimately leading to greater profitability and success

What is NetSuite Fixed Asset Management? The Explanation

NetSuite Fixed Assets Management provides the ability to eliminate spreadsheets and manual work from your organization’s asset and lease management processes.

NetSuite Fixed Asset Management is a cloud-based software solution that helps businesses track and manage their fixed assets. NetSuite Fixed Asset Management provides a centralized platform for businesses to manage their fixed assets throughout their entire lifecycle, from acquisition to disposal. The software automates several of the tasks involved in fixed asset management, such as calculating depreciation, tracking maintenance schedules, and generating reports.

One of the critical features of NetSuite Fixed Asset Management is its ability to calculate depreciation. Depreciation is the decrease in the value of an asset over time, and it is an important accounting concept that businesses must track for tax and financial reporting purposes.

Another essential feature of NetSuite Fixed Asset Management is its ability to track maintenance schedules. NetSuite Fixed Asset Management helps businesses track maintenance schedules for each asset, ensuring that they are adequately maintained and repaired as needed.

NetSuite Fixed Asset Management also provides comprehensive reporting capabilities, allowing businesses to generate detailed reports on their fixed assets. These reports can include information such as the current value of each purchase, its depreciation schedule, and its maintenance history. This information plays a significant role in making informed decisions about the replacement or sale of assets and complying with accounting and tax regulations.

Importance of Asset Management in NetSuite

Company expenses at the time of purchase illustrate the importance of fixed asset management. In most companies, fixed assets account for 40% or more of total expenses. Therefore, effective management of assets is essential to get the maximum benefit from them.

Tracking all of a company’s assets can be challenging, so the potential for significant losses increases as the company’s size increases. In addition, assets, plants, and equipment that are not in top condition hinder production, resulting in substandard goods and services, poor customer satisfaction, and a negative impact on the company’s reputation. With NetSuite, asset management becomes even more critical as it provides a comprehensive platform to manage and optimize assets throughout their lifecycle. Asset management in NetSuite constitutes an essential function that helps businesses improve visibility, compliance, resource utilization, decision-making, transparency, and accountability. With its comprehensive asset management capabilities, NetSuite allows businesses to streamline their asset management processes and optimize their overall performance.

The Four Modules of NetSuite Fixed Asset Management

There are four primary modules of NetSuite Fixed Asset Management:

Adding an Asset

NetSuite Fixed Asset Management tracks all asset-related transactions. Invoices, sales orders, and purchase invoices can all be converted to fixed assets. The only requirement is that the transaction is posted to a fixed asset account. A fixed asset cannot be generated from a transaction unless credited to a fixed asset account. Additionally, you can manually create assets or import CSV data. An investment proposal is the first phase of the fixed asset register. The investment proposal page contains information about all transactions posted to your investment account. You can choose to reject or accept the proposal on this page. If the proposal is approved, the fixed asset will be set up using the asset-type transaction’s default account details (depreciation method, lifetime, salvage value, etc.). This information may change if the value of the new property changes before the application is approved.

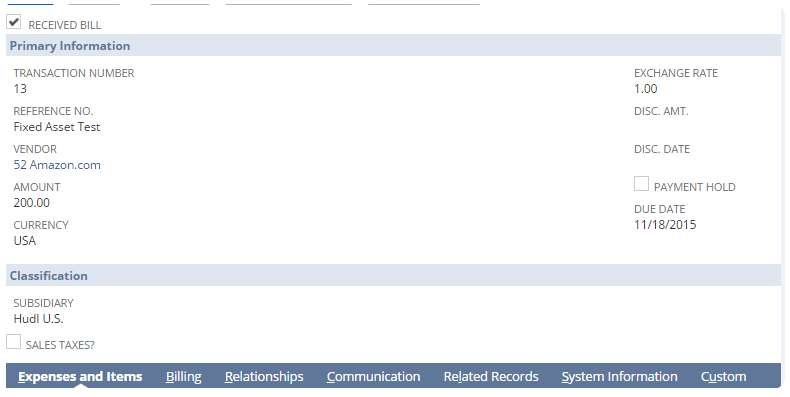

Step 1: Enter Your Order/PO /Receipt/Invoice/Bill.

Timing: Enter as needed throughout the month.

Navigation: Receive a PO or enter invoices directly via Transactions> Payables > Enter Bills.

The purchase order/invoice should be coded directly to the asset account with a description of the asset in the memo field.

Step 2: Propose An Asset In The Netsuite Fixed Assets Module.

Timing: Once a month, closing at the end of the month.

Navigation: Fixed Assets > Transactions > Proposal

- Under Asset Types, select one or more asset types to generate asset suggestions

- Under Subsidiaries, select one or more subsidiaries (or click the Include Children check box for all subsidiaries).

- Click the Propose New Asset button.

NOTE: Nothing may appear to be happening, but NetSuite is processing asset suggestions in the background.

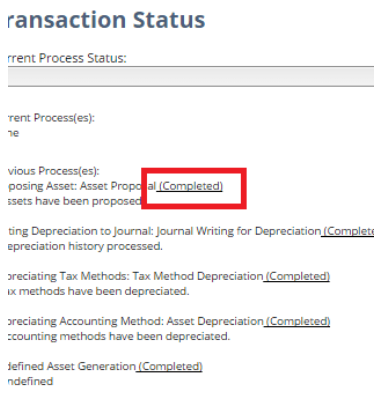

- To get a glance at what’s going on, you can go to Fixed Assets > Transactions > Transaction Status.

- You can see an overview of active and completed processes on the Transaction Status screen.

- From there, you can click Hyperlinks to view details. As long as it says “Record Processed,” it’s safe to continue.

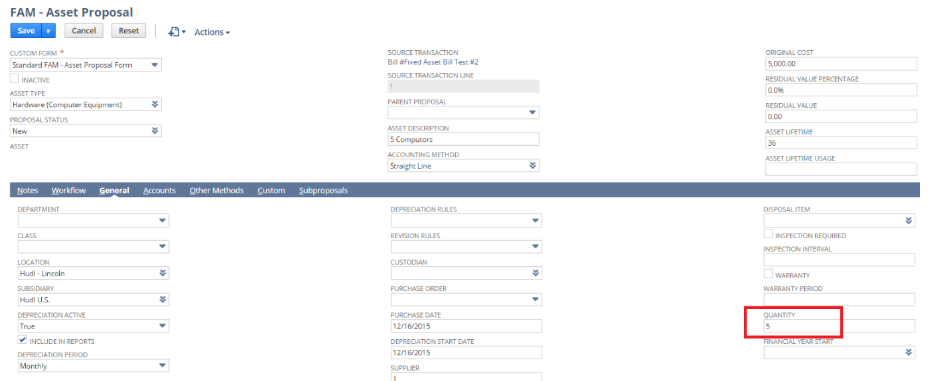

Step 3: Decline Or Generate Assets.

Timing: Once a month, during the closing at the end of the month.

Navigation: Fixed Assets > Transactions > Proposals

We encourage you to review each proposed asset to ensure details are updated accordingly. For example, if you purchase 5 computers on one of your invoices/property proposals, the quantity should be set to 5 in the FAM – Asset Proposal record. You can also change other aspects of the asset at this point. B. Depreciation Depreciation method, depreciation start date, etc.

- Click Save when you’re done.

- Back on the Asset Proposal screen, select an Asset by checking the box to the left of it, then click Generate Assets (or Reject Assets) at the top.

NOTE: As with the new asset proposal, NetSuite doesn’t seem to handle them. As in step 1, you can follow the same navigation to view your deal status.

Depreciation of Asset

Timing: Once a month, during closing at the end of the month.

Navigation: Fixed Assets > Transactions > Fixed Asset Depreciation.

- Under Asset Types, select one or more asset types to generate asset proposals.

- Under Subsidiaries, select one or more Subsidiaries (or select the Include Subsidiaries check box for all Subsidiaries).

- Enter the last day of the month in the Depreciation Period section (for example, 12/31/15).

- You can enter the JE reference number in the Depreciation Reference field or leave the field blank and let NetSuite automatically generate the reference number.

- When finished, click the Asset Depreciation button.

NOTE: Unlike other processes, this step takes you directly to the transaction status screen, where you can see how many transactions have been processed.

NOTE: To view posted journal entries, go to Transactions > Financials > Make Journal Entries > List and Select the recent one (i.e., you can sort by the latest internal ID).

NOTE: You can also check the depreciation associated with a specific fixed asset by navigating to Fixed Assets > Lists > Assets and selecting the asset in question to review the depreciation entries posted on the FAM – Fixed Asset record. You can view posted depreciation entries by checking the Depreciation History Tab.

Asset Revaluation

Timing: As required/needed.

Navigation: Fixed Assets > Transactions > Asset Revaluation.

- Select an asset in the Asset ID/Name field.

- Enter a “Write-down %” or “Write-down Amount” and/or adjust the “Residual Value”, “Lifetime”, and “Depreciation Method”.

- Enter a “Transaction Date”.

- Click the Calculate button to see the write-down % amount before processing or

- Click the Process Revaluation button to process.

NOTE: You will be taken to the transaction status screen once the re-evaluation is complete.

NOTE: The amount can be verified by going to Fixed Assets > Lists > Assets, selecting the asset in question, and reviewing the depreciation entries published in the FAM – Asset record. You can view the posted journals by checking the Depreciation History tab.

Dispose of an Asset

Timing: As required/needed.

Navigation: Fixed Assets > Transactions > Asset Disposal

- Select an asset in the Asset ID/Name field.

- You can create customer invoices when you sell assets by entering the “Sale Item“, “Customer“, and “Sale Amount” in the appropriate fields.

IMPORTANT: Make sure the sale item is associated with the Asset Sale Gain/Loss ledger account

- Enter the “Disposal Date” and ‘Disposal Type” (for example, sell or write off).

IMPORTANT: You can depreciate or sell portions of an asset record that have multiple quantities by entering different amounts in the “Quantity Disposed ” field.

- Click Disposed when finished.

NOTE: You will be directed to the transaction status screen, where you can check the completion of processing.

NOTE: You can verify the amount by reviewing the sale write-off entry posted to the FAM – Asset Record by navigating to Fixed Assets > Lists > Assets and selecting the Asset in question. You can see the journal entry posted by reviewing the Depreciation History tab.

NOTE: You can the Disposal/Invoices posted to FAM – Asset records by going to Fixed Assets > Lists > Assets and selecting the relevant asset. Invoices issued can be viewed on the Asset Sale/Disposal tab.

Advantages and Benefits of NetSuite Fixed Asset Management

Asset management is an essential function for any organization, as it allows businesses to track and manage their assets efficiently. With NetSuite, asset management becomes even more critical as it provides a comprehensive platform to manage and optimize assets throughout their lifecycle.

Assets Visibility

One of the key benefits of asset management in NetSuite is improved visibility. With NetSuite, businesses can easily track their assets, including acquisition, depreciation, and maintenance, all in one place. This allows businesses to gain a better understanding of the value and usage of their assets, helping them make informed decisions about purchasing, maintenance, and replacement.

Compliance

Another important aspect of asset management in NetSuite is compliance. NetSuite ensures that businesses comply with accounting and tax regulations by automatically calculating depreciation and generating reports. This reduces the risk of errors and make sures that businesses remain in compliance with relevant laws and regulations.

Real-Time Tracking

Asset management in NetSuite also helps businesses optimize their use of resources. By tracking asset usage and maintenance schedules, businesses can ensure that their assets are used efficiently and effectively. This can help reduce downtime, increase productivity, and save costs on unnecessary repairs or replacements.

Business Insights

NetSuite’s asset management capabilities provide businesses with accurate and up-to-date information, which is crucial for making strategic decisions. For instance, by analyzing asset usage and maintenance data, businesses can identify trends, predict potential issues, and plan for future asset acquisitions and replacements.

Transparency and Accountability

Asset management in NetSuite helps businesses increase transparency and accountability. By having a centralized system that tracks all asset-related activities, companies can ensure that their teams are held accountable for their actions. This also helps prevent theft and misuse of assets, providing greater security and peace of mind.

Reduces use of manual administrative procedures

Instead of using spreadsheets and whiteboards, wealth management software automates the wealth management process. This approach results in fewer errors, more accessible information sharing, faster historical asset data retrieval, and easier system deployment. As mentioned earlier, spreadsheets are equally helpful. Soon, you’ll need features only available in high-end asset management programs like NetSuite Fixed Asset Management.

Conclusion

In summary, NetSuite Fixed Asset Management is a powerful software solution that helps businesses track and manage their fixed assets. By automating many of the tasks involved in fixed asset management, such as calculating depreciation and tracking maintenance schedules, NetSuite Fixed Asset Management helps businesses save time and reduce errors. Its comprehensive reporting capabilities also enable businesses to make informed decisions about their fixed assets and comply with accounting and tax regulations.