Your current payment system is killing your business slowly because you are not leveraging Stripe Integration with NetSuite. Every day you stick with manual processes, you’re losing money, wasting time, and making your business more vulnerable to costly mistakes. While you’re buried in paperwork and endless data entry, your competitors are moving faster, using smart technology to run their finances smoothly. This isn’t just about saving time – it’s about keeping your business competitive and avoiding the kind of operational mess that can bring everything crashing down.

Do you believe manual transaction processing is just a standard part of doing business? It shouldn’t be. As your business grows, manual data entry quickly becomes a bottleneck, slowing down operations, increasing the risk of errors and cutting into your profitability. Each transaction becomes a potential point of failure: miskeyed figures, duplicate records, and missed revenue opportunities. Instead of focusing on strategic growth, your team is stuck managing inefficiencies that could easily be automated.

Is your financial reporting process more complex than it needs to be? Relying on disconnected spreadsheets, manual entries, and inconsistent data makes it difficult to get a clear and accurate view of your financial health. Even a small error can lead to costly missteps, misinformed decisions, and compliance risks. Without the right systems in place, financial management becomes less about strategy and more about risk control.

Handling refunds and chargebacks manually is both time-consuming and risky. Each mishandled refund is a customer walking out the door, potentially taking future business with them. You're losing money, reputation, and customer trust with every confusing interaction. Your current process doesn't just cost you money – it's actively destroying your business's credibility.

Your disconnected systems are creating a customer data horror show. Duplicate records, inconsistent information, fragmented transaction histories – you're treating your customers like random data points instead of valuable relationships. Every customer support call becomes a painful investigation, burning time and money while your customers grow increasingly frustrated.

Think you can handle growth with your current setup? Think again. Every transaction volume spike becomes an operational nightmare. You'll be hiring more staff, creating more complicated workflows, and spending less time on what actually matters – growing your business. Your "solution" is creating more problems than it solves.

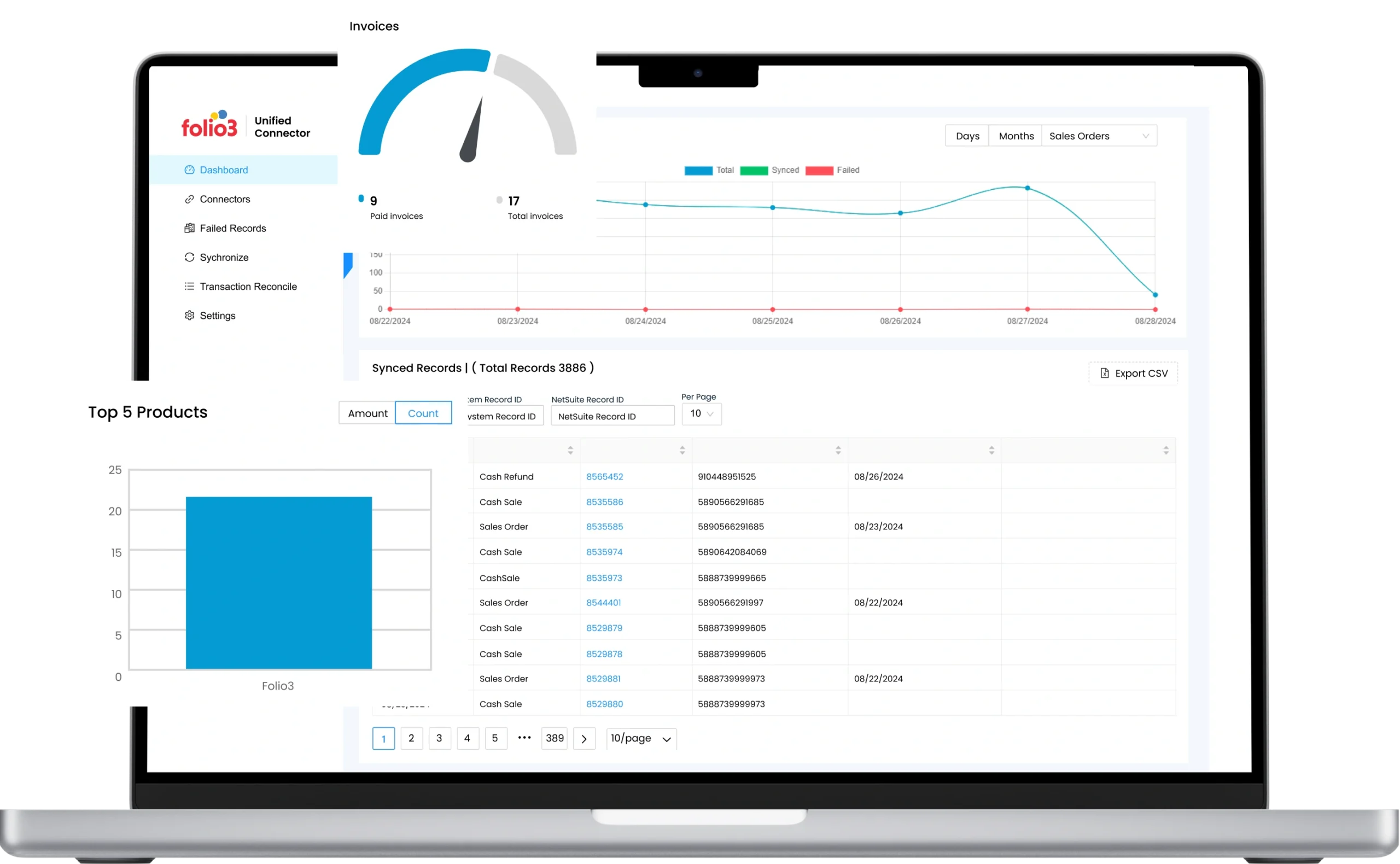

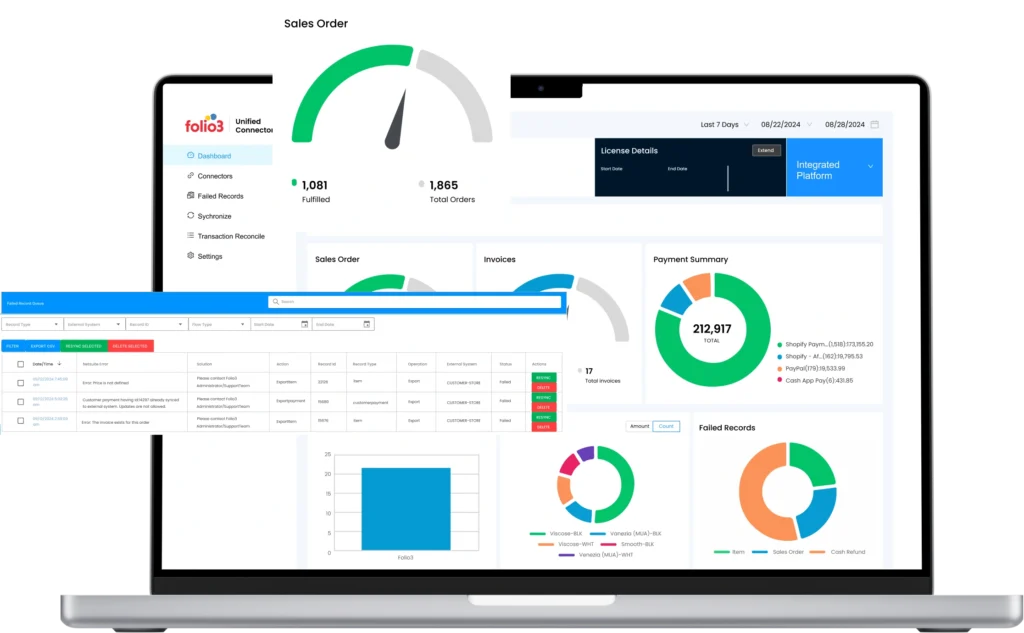

See how businesses streamline their fulfilment process, eliminate manual data entry, and prevent inventory errors with Folio3’s turnkey Stripe NetSuite Connector.

Automatically transfer payment data from Stripe to NetSuite with complete accuracy using Stripe Integration with NetSuite. Transaction details, customer information, and payment status flow seamlessly between systems without manual work. Reconciliation updates sync back to NetSuite, giving your team up-to-date visibility into every financial transaction.

Keep customer information synchronized across payment and financial platforms. Prevent data inconsistencies and duplicate records by maintaining accurate customer profiles. As payments process, customer details update automatically, eliminating the risk of fragmented customer information.

Support multiple payment methods and processing channels in one integrated system using Stripe NetSuite Integration. Payment preferences, transaction details, and receipt information flow back to NetSuite automatically, providing a complete view of your financial operations.

Handle refunds and chargebacks efficiently without jumping between systems. Refund requests sync between platforms, financial records update automatically, and customers receive faster resolution. Stop wasting hours on manual reconciliation and reclaim time for strategic financial planning.

Get deep insights into your payment performance with comprehensive reports from both systems, with Stripe Integration with NetSuite. Track revenue streams, transaction costs, and payment accuracy to identify opportunities for improvement. Spot potential financial issues before they impact your business performance.

Adapt the integration to fit your unique business requirements instead of changing your processes. Custom field mappings and financial workflows ensure the system works exactly how you need it to. Scale confidently knowing your integration can handle growing transaction volumes.

Managing your payments shouldn’t be a hassle when you have Stripe Integration with NetSuite. With NetSuite Stripe Integration, you can speed up your payment processes, improve financial accuracy, and scale your business without adding extra work. Whether you’re processing a few payments or thousands, this integration makes it easy to stay in control and keep your financials clean and reliable.

Process payments in minutes, not hours. Automatic data transfer eliminates manual reconciliation with Stripe NetSuite Connector.

Maintain accuracy across reporting, customer records, and transactions in both systems.

Handle increased payment volume effortlessly, without additional staff or complexity.

Get up-to-date visibility into payments, revenue, and customers to optimize operations and profits.

Our pre-built Stripe NetSuite Connector is personalized to address diverse business needs. If you require specific features or workflows, we can customize the integration to fit your unique requirements. Whether you want to add additional fields, custom workflows or scale the system as your business grows, our solution offers the flexibility to adapt.

| Feature | Doing It Manually | Other Integration Solutions | Folio3’s Stripe Connector |

|---|---|---|---|

| Scalability | Breaks down as business grows; cannot handle increased volume | Performance issues with large data sets and high transaction volumes | Enterprise-grade architecture that scales with your business growth without performance degradation |

| Support & Maintenance | No dedicated support; internal IT burden | Limited support with variable response times | Dedicated support with 5 days of post-go-live assistance and optional 24/7 support plans |

| NetSuite infrastructure | Relying on manual spreadsheets | Built on middleware platforms, leads to potential security risks | Hosted directly on NetSuite’s infrastructure for superior reliability and security |

| Customization | Requires complete rebuilding for any changes | Limited options with rigid frameworks make it inflexible and costly | Fully customizable with additional workflows and features tailored to your specific business needs |

| Pricing | Hidden costs in staff time, errors, and missed opportunities | Subscription-based with additional fees for customization and premium features | Transparent pricing with all-inclusive packages and no hidden implementation fees |

Hear directly from our clients who have transformed their business operations with our NetSuite integration expertise.

Folio3’s team has been a great help to our organization. Over the past 12 months, they’ve shown dedication and hard work, building a strong relationship with our teams across regions.

Folio3’s team understood our unique requirements and tailored the connector’s functionality to fit. Their support during the transition was excellent, and we look forward to further collaboration.

The Stripe NetSuite Integration is designed to work seamlessly with your existing NetSuite setup, including customized configurations. It integrates directly with NetSuite’s infrastructure, ensuring smooth functionality without conflicts. Folio3’s NetSuite Stripe Connector can be tailored to fit your specific business needs.

If you encounter issues during the NetSuite Stripe integration process, you can rely on Folio3’s dedicated support for the NetSuite Stripe Connector. We offer post-implementation support, including 5 days of assistance and optional 24/7 support plans. Our Stripe NetSuite Integrator experts are available to help resolve any challenges.

The implementation timeline for the Stripe and NetSuite Connector depends on the complexity of your business processes and existing systems. On average, the integration can be set up within a few weeks, with most tasks completed in less than a month. The Stripe NetSuite Integration is optimized for rapid deployment.

Absolutely. The NetSuite Stripe Integrator is highly customizable, allowing you to map custom fields, set specific workflows, and adapt the integration to your unique business requirements. Whether it’s for custom payment methods or unique transaction handling, the Stripe NetSuite Integration can be tailored for your needs.

No additional software is required for the Stripe NetSuite Integration. The integration works directly with NetSuite’s ERP system, ensuring that payment data flows seamlessly from Stripe into your NetSuite environment. All the necessary tools are included in the package.

The Stripe and NetSuite Connector supports international transactions and multi-currency processing. You can manage payments and customer data across borders without additional manual intervention. This makes the Stripe ERP Integration ideal for global businesses.

If a payment needs to be canceled or modified after syncing, the NetSuite Stripe Integrator supports partial refunds and chargebacks. Any changes to payments, refunds, or transactions can be reflected instantly between NetSuite and Stripe, ensuring accurate financial records.

With the NetSuite and Stripe Integration, you can leverage the combined data from both platforms to generate comprehensive financial reports. Instant transaction updates, revenue tracking, and customer insights allow for better forecasting and more accurate financial planning in NetSuite Stripe integration. The integration provides a clearer financial picture, making it easier to optimize operations.

By submitting the form you agree to terms & condition and privacy policy of Folio3

© 2025, Folio3 Software Inc. All rights reserved.