For any business to run smoothly, it must make sure that its accounting processes are just as perfect. Therefore, companies need to select accounting software that provides robust features and can scale as their business grows. NetSuite is one of those accounting software that provides top-notch features that help startups, SMS, and enterprises manage their core business operations without any hassle.

From features like advanced analytics, mobile support, payroll, and asset tracking, to budgeting and project accounting, accounting software must have these to get started.

How to use NetSuite for accounting is one of the most asked questions, so we decided to make a detailed guide about it. Let’s understand how you can leverage it to your advantage to its full potential.

How to Use NetSuite for Accounting?

NetSuite is used for accounting by automating the entire financial management lifecycle. It includes managing the general ledger and journal entries to handling accounts payable and receivable, billing, and regulatory reporting. It’s a cloud-based ERP system that allows businesses to process financial transactions, maintain audit trails, and generate real-time financial insights, all within a centralized platform.

NetSuite Functionalities

If we talk about the core NetSuite accounting functionalities, it starts with the general ledger, from here it automatically posts transactions from across the system, whether they originate from sales, purchasing, payroll, or other modules.

This feature of NetSuite entirely reduces manual effort and keeps the chart up to date. You will also have customizable segments like departments, locations, and classes.

Finance teams can track financial performance across any structure the business requires.

Accounts Payable Processing Using NetSuite

Accounts payable processes are streamlined through vendor bill entry, approval workflows, and batch payment scheduling. Accounts receivable is handled through automated invoicing, cash receipt application, and collections tracking.

The system also supports complex billing arrangements, including subscriptions, milestones, and usage-based models, and automatically recognizes revenue in compliance with standards like ASC 606 and IFRS 15.

NetSuite has fixed asset management that works on handling asset acquisition, depreciation, and disposal without requiring separate tools

The bank reconciliation process is made easier by directly importing bank data and matching transactions with system entries.

For global businesses, it also offers the OneWorld feature that supports multi-currency, multi-entity, and tax compliance across countries, enabling real-time consolidated reporting without manual spreadsheet work.

The bottom line is that you can do A LOT with NetSuite accounting, ranging from a centralized checklist, task assignments, and real-time dashboards that track progress.

In addition to that, you can also create various reports like the balance sheet, income statement, cash flow, and custom KPIs.

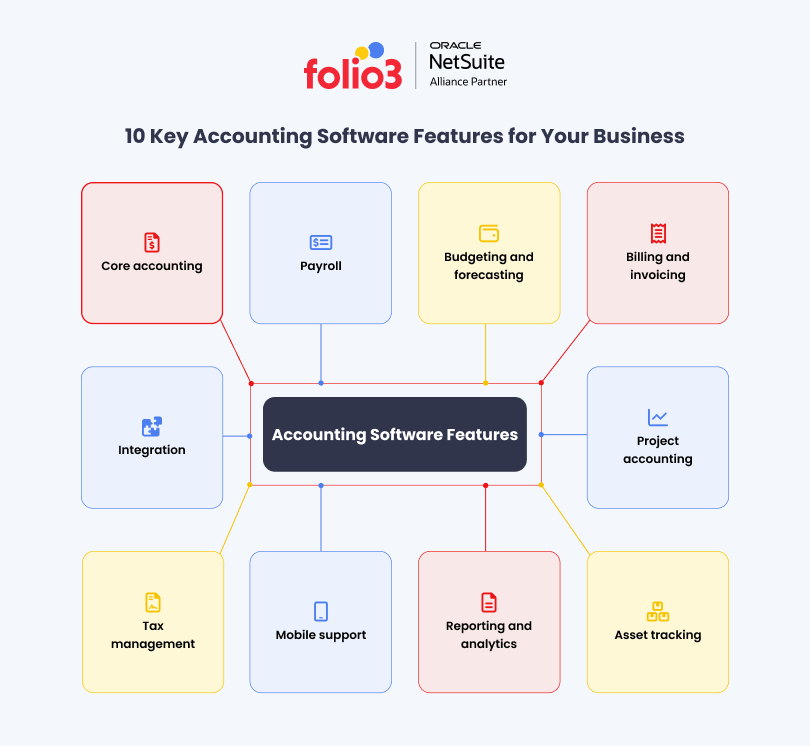

Key Accounting Software Features for Your Business

The key accounting software features to handle business tasks include core accounting, payroll, budgeting and forecasting, billing and invoicing, project accounting, asset tracking, mobile support, reporting and analytics, mobile support, tax management, and integration.

Below is a brief overview of these features to help you understand how they work in NetSuite.

1. Core Accounting

The purpose of accounting software is to provide comprehensive support for the core functionalists. These core functions include recording and categorizing transactions, general ledger management, and the charts of accounts, generating financial statements, and other miscellaneous reports.

All these functions are important to the business of every organization.

Accounting software like NetSuite automates basic bookkeeping and accounting functions along with workflows. It includes creating journal entries, reconciling accounts, and performing basic calculations.

Another key feature of NetSuite accounting is that it has the ability to comply with regional standards (it is so important that we can emphasize it enough).

Many companies with global clients and accounting software allow businesses to toggle quickly between the GAAP standard used in the U.S. and the IFRS used in other countries. This is particularly helpful for growing businesses with international operations.

2. Payroll

Another top feature of accounting software is payroll management.

When companies start to scale and their number of employees increases, payroll becomes too complicated to be handled manually.

Accounting software like NetSuite offers integrated payroll management software that automates calculations that include gross and net pay, payroll tax withholding, health benefits, recruitment benefits, and other expenses that are included in payroll.

When businesses use accounting software, it automatically creates mandatory W-2, 1099-MISC, and other forms.

Some software can automatically scan and analyze timesheets and cut checks or even directly deposit funds into employees’ bank accounts.

Budgeting and Forecasting

Budgeting and forecasting are one of the most important business processes, and they use a combination of historical and real-time data for creating budgets.

Accounting software is used to forecast, which helps managers project future business performance.

Whether it’s a startup, small to medium-sized business, or an enterprise, use accounting software like NetSuite, and they can track actual performance against the budget to identify and address any problems.

It is best for professionals like managers and finance specialists to drill into the details and pinpoint specific areas that have exceeded the budget. Hence, it gives an overall view of budgeting.

4. Billing and Invoicing

Billing and invoicing in accounting software are used to accelerate cash flow through automation.

For accounts receivable, accounting software like NetSuite can automatically generate invoices, manage credit items, and even improve payment collection by setting up alerts.

Those who manage accounts receivable can leverage NetSuite accounting software to track the status of all outstanding invoices, view each customer’s payment history, and monitor key performance metrics, such as days sales outstanding (DSO).

5. Project Accounting

When there are multiple projects in a company, each project has to be accounted for revenue and expenses.

The most apt examples for project accounting are construction firms, consulting companies, and those organizations that take project-based work for clients.

The main benefit of accounting software like NetSuite is that it can simplify bookkeeping tasks required for project accounting by automating the allocation and tracking of project revenue and expenses.

6. Asset Tracking

Many large-scale companies and enterprises have investments in long-term assets. These assets could be machinery, vehicles, and real estate. Not only that, but short-term assets like inventory need tracking.

By using accounting software like NetSuite, companies can track the value and other details related to the fixed assets over the entire useful lifespan and which can be complicated.

For this, they need robust software for fixed assets and inventory management in order to track the company’s total asset base.

By using fixed asset management software, companies can automate depreciation calculations, typically with the ability to use different methods for GAAP compliance and for tax purposes as necessary.

7. Reporting and Analytics

To manage financial statements such as income statements or balance sheets more quickly and accurately, companies use accounting software. The traditional methods have become obsolete.

By leveraging accounting software like NetSuite, companies can get robust reporting features that help managers and financial specialists monitor the company’s business performance.

Top accounting software like NetSuite provides customization, role-based, real-time dashboards, and analytics that enable financial teams to keep tabs on key financial metrics and drill down to explore trends and issues.

8. Mobile Support

Every software approach is mobile-first, and this is exactly what companies want.

One of the key features of the top accounting software is that it provides mobile support that enables staff to access the information whenever they need it.

Employees can easily switch between desktop and mobile devices so that they have access to the most updated data.

Mobile apps for the accounting software include customizable dashboards that let employees track key metrics, tasks, and reminders, as well as enter and approve transactions.

9. Tax Management

Tax management is undoubtedly one of the most complex processes.

Accounting software simplifies the tax processes by automatically performing complex calculations that are in accordance with local, national, and global requirements.

It enables businesses to be sure about the fact that they are paying and collecting the appropriate taxes wherever they conduct business and that they have detailed line-item records available when needed.

Best accounting software like NetSuite enables businesses to use custom rules to automatically calculate local tax obligations for both domestic operations and international subsidiaries, including U.S. sales taxes, goods and service taxes (GST), and value-added tax (VAT). It offers a tool known as NetSuite TaxSuite that makes business tax management much more manageable with its powerful tools.

10. Integration

The option for integration with other applications is the topmost requirement for startups, SMBs, and enterprises.

Accounting software integration with an ERP suite like NetSuite reduces the need for manual data transfer between applications within the suite.

By integrating your accounting software with ERP, you have your financial data synchronized with information produced by other applications within the suite, such as sales and manufacturing data. It also reduces the likelihood of data-entry errors.

For instance, if you integrate your accounting software with customer relationship management (CRM), systems can help businesses provide a better customer experience by providing customer service teams with real-time data about customer payments.

Best Practices to Follow: How to Use NetSuite for Accounting

If you want to get maximum advantages out of the accounting software, then you must follow some of the best practices, such as automation, customization, using role-based dashboards, implementation budget tracking, and implementation of internal controls.

1. Leverage Automation for Month-End Close

It is best to use NetSuite’s automated journal entries, transaction matching, and real-time reporting to speed up the month-end close. Automating recurring entries and reconciliation processes reduces manual work and errors.

2. Customize Your Chart of Accounts

The best practice to get the maximum out of the accounting software is customizing your chart of accounts to fit your organization’s reporting structure.

NetSuite allows you to define segments like departments, classes, and locations to support multidimensional reporting and compliance needs.

3. Use Role-Based Dashboards

Set up dashboards by role (e.g., Controller, CFO, AP Clerk) so each user sees only the KPIs, reports, and workflows relevant to them. This improves efficiency and limits access to sensitive data.

4. Enable Real-Time Budget vs. Actual Tracking

Take advantage of NetSuite’s budgeting and forecasting tools to track actuals in real time against your financial plan. Set alerts for budget deviations and use SuiteAnalytics for deeper variance insights.

5. Implement Internal Controls with Permissions & Workflows

Set up strong financial controls using NetSuite’s role permissions and SuiteFlow for approvals. This helps prevent unauthorized transactions and enforces consistent accounting policies across departments.

Customizing NetSuite for Accounting

NetSuite’s flexibility allows finance teams to tailor the system to match their exact accounting workflows, compliance requirements, and reporting needs.

By using its SuiteCloud customization tools, businesses can configure NetSuite without compromising future updates or system stability.

Here’s how you can customize NetSuite specifically for accounting functions:

- Custom General Ledger Segments

Add user-defined dimensions to financial transactions beyond departments or locations, such as fund codes, cost centers, or grant tracking, for more granular reporting. - Workflow Automation

Use SuiteFlow to automate accounting processes like journal approvals, vendor payment validations, or expense report routing. This reduces manual bottlenecks and ensures policy compliance. - Customized Financial Reports

Tailor financial statements (P&L, Balance Sheet, Cash Flow) to reflect your preferred formats and KPIs. With SuiteAnalytics, you can build saved searches, pivot tables, and dashboards for real-time insights. - Tax Compliance Configuration

Configure tax codes, tax schedules, and automated tax calculations based on regions, making NetSuite compliant with local and international tax regulations. - Custom Roles & Permissions

Set up custom roles for accountants, auditors, controllers, and CFOs, each with access only to the features and records they need. This improves internal control and segregation of duties. - Automated Revenue Recognition Templates

For companies under ASC 606 or IFRS 15, customize revenue arrangements and rules for accurate, automated recognition tied to performance obligations.

Simplify Workflows and Improve Financial Accuracy with Folio3

NetSuite is one of the best accounting software for startups, SMBs, and enterprises as you can easily streamline tax procedures, get robust ledger management, and have real-time analytics.

Folio3 brings 20+ years of expertise and a deep understanding of both financial systems and ERP technology.

Our team of certified NetSuite consultants and chartered accountants specializes in helping accounting and financial services firms streamline operations, improve compliance, and gain real-time visibility into performance.

Book a consultation today with NetSuite experts.

Frequently Asked Questions

What is NetSuite used for in accounting?

NetSuite is used in accounting to manage core financial tasks like general ledger, accounts payable/receivable, billing, tax management, and financial reporting. It automates processes, improves accuracy, and gives real-time visibility into cash flow and financial performance.

Is NetSuite a good accounting system?

Yes. Its features provide scalability and support complex financial requirements, comply with global accounting standards, and integrate seamlessly with other business functions like inventory, CRM, and e-commerce. But, we have a quick guide for you that will help you learn NetSuite quickly 👉 How to learn NetSuite

Is NetSuite easy to learn?

No, NetSuite is not easy to learn. It has a learning curve, especially for users new to ERP systems, but it becomes intuitive with regular use. End users typically adapt quickly to role-based dashboards, while admins and accountants may need training to fully utilize their capabilities.

Does NetSuite have an accountant version?

NetSuite doesn’t have a separate “accountant version,” but it offers extensive accounting features within its ERP platform. It also allows for custom roles and permissions, so external accountants or finance teams can be granted specific access to the data they need.